206: From Toys to Titles: The Gift of Real Estate for Your Children’s Future

Investing in Your Children’s Future: Why Real Estate Is the Ultimate Gift

When we think about giving to our kids, our first thought often goes to toys, savings accounts, or maybe even a college fund. But what if the greatest gift you could give your children isn’t a toy or even cash—it’s an asset that grows with them? That’s where real estate comes in.

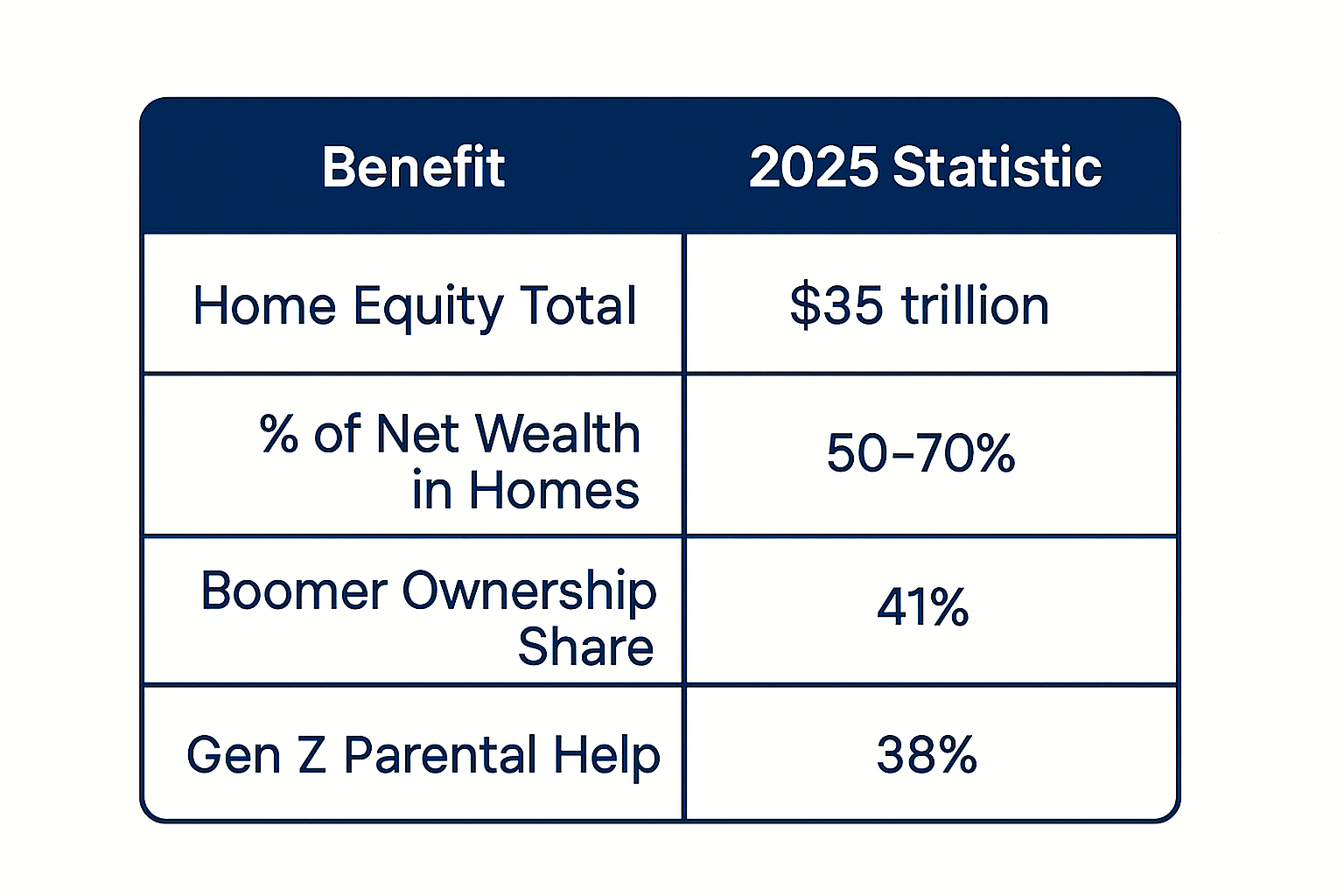

Unlike savings or short-term gifts, property has the power to appreciate over decades, creating equity that can change the financial trajectory of a family. And here’s the truth: this strategy isn’t just for millionaires. For many middle-income families, real estate already makes up 50–70% of their net worth.

Why Real Estate Matters

Generational Impact: Baby boomers currently own 41% of U.S. real estate, while 38% of Gen Z homeowners report getting help from their parents to buy their first property.

Growing Equity: As of 2025, there’s a staggering $35 trillion in total home equity across the country. That’s wealth that’s not just sitting—it’s building.

More Than Savings: While savings accounts may sit stagnant, a home or rental property has the potential to appreciate, provide rental income, and serve as leverage for the future.

Strategies for Parents Who Want to Invest for Their Kids

Start Small, Think Smart

A condo, duplex, or modest rental is often more powerful than waiting years for the “perfect” property. Even homes with HOAs can work—consider it like a built-in property manager.Leverage Wisely

You don’t need millions to begin. Mortgages can be a tool—but choose carefully. A 15-year loan over a 30-year loan can make all the difference, especially when paired with tax-smart strategies like rental deductions.Teach Along the Way

Every renovation, property tour, and rent collection is a financial education. Teaching your children about concepts like BRRR (Buy, Rehab, Rent, Refinance, Repeat) sets them up with real-world business skills.Plan for the Future Transfer

Protect your investment with trusts and legal structures. Passing down property the right way ensures it stays in the family—and continues to benefit future generations.Consider Co-Signing

Helping your child buy their first property by co-signing can reduce their risk while teaching them the ropes of ownership.

Legacy Over Luxury

Imagine your college graduate walking away not just with a degree, but with an asset—something they can live in, rent out, or use as leverage for their next purchase. That’s the power of long-term thinking.

Life doesn’t always go the way we plan. But by gifting real estate instead of just short-term luxuries, you can help your children begin their adulthood without debt—and with a foundation that appreciates over time.

This isn’t just a gift. It’s a legacy.

listen to the full episode

on your favorite podcast streamer below.

-> Apple

-> Spotify

______________________________________________________________________

Extra Real Estate with Soul Links you can’t miss!

Are you SUBSCRIBED to our YouTube Channel?

Subscribe at https://www.youtube.com/c/LoriAlvarez and tell us you did by messaging us on our

Felt inspired by this episode? Let us know! We'd love to hear from you by leaving our Podcast a review. And you just might get a special shout-out on the podcast! Thanks for choosing to spend your time with us!

Want more behind the scenes?

Like our Real Estate With Soul, The Podcast Page on Facebook

- Agent 4

- Airbnb 1

- Buy and Sell Real Estate 41

- Buyer 43

- Buyer Agent 1

- Buying 23

- Buying young 2

- COVID 1

- California real estate 46

- California real estate market 28

- Career 9

- Community 11

- Dave Ramsey 3

- Eco-friendly 1

- FSBO 1

- Family 6

- Financial Planning 7

- Goal Setting 15

- Guest 23

- Holidays 4

- Homeowner 22

- Homeshowings 1

- Inspections 2

- Insurance 2

- Investing 13

- Legal 1

- Lender 5

- Market 11

- Market Trends 1

- Market Update 10

- Mindset 28

- Mortgage 6

- Moving to California 6

- Owning Property 1

- Photos 1

- Pools 1

- Real Estate 2023 23

- Real Estate 2025 30

- Real Estate Agent 86

- Real Estate Fraud 1

- Real Estate Questions 1

- Real estate 2023 23

- Realtor 8

- Renting 2

- Safety 4

- School 4

- Seller 40

- Selling 23

- Testimonial 1

- The Real Value of a REALTOR 2

Disclaimer: Please verify all information with the licensed professional of your choice.