218: Trump's 50 year mortgages, what does it mean for you?

The Truth About 50-Year Mortgages: Lower Payments, Bigger Risks?

A new housing proposal is making headlines — a 50-year mortgage, reportedly being explored by the Trump administration as a solution to America's affordability crisis. The idea is simple: stretch out the loan term to reduce monthly payments so more families can qualify for a home. But as always in real estate… the math tells a deeper story.

Let’s look at what this could really mean for buyers, sellers, investors, and the housing market as a whole.

Why a 50-Year Mortgage Is Being Considered

In a market where the median U.S. home price sits around $410,000, affordability has become one of the biggest barriers in modern history. Extending loan terms is being pitched as a quick fix — pay less each month by spreading payments across five decades.

And yes… the monthly payment goes down.

But the long-term cost? That’s where things get shocking.

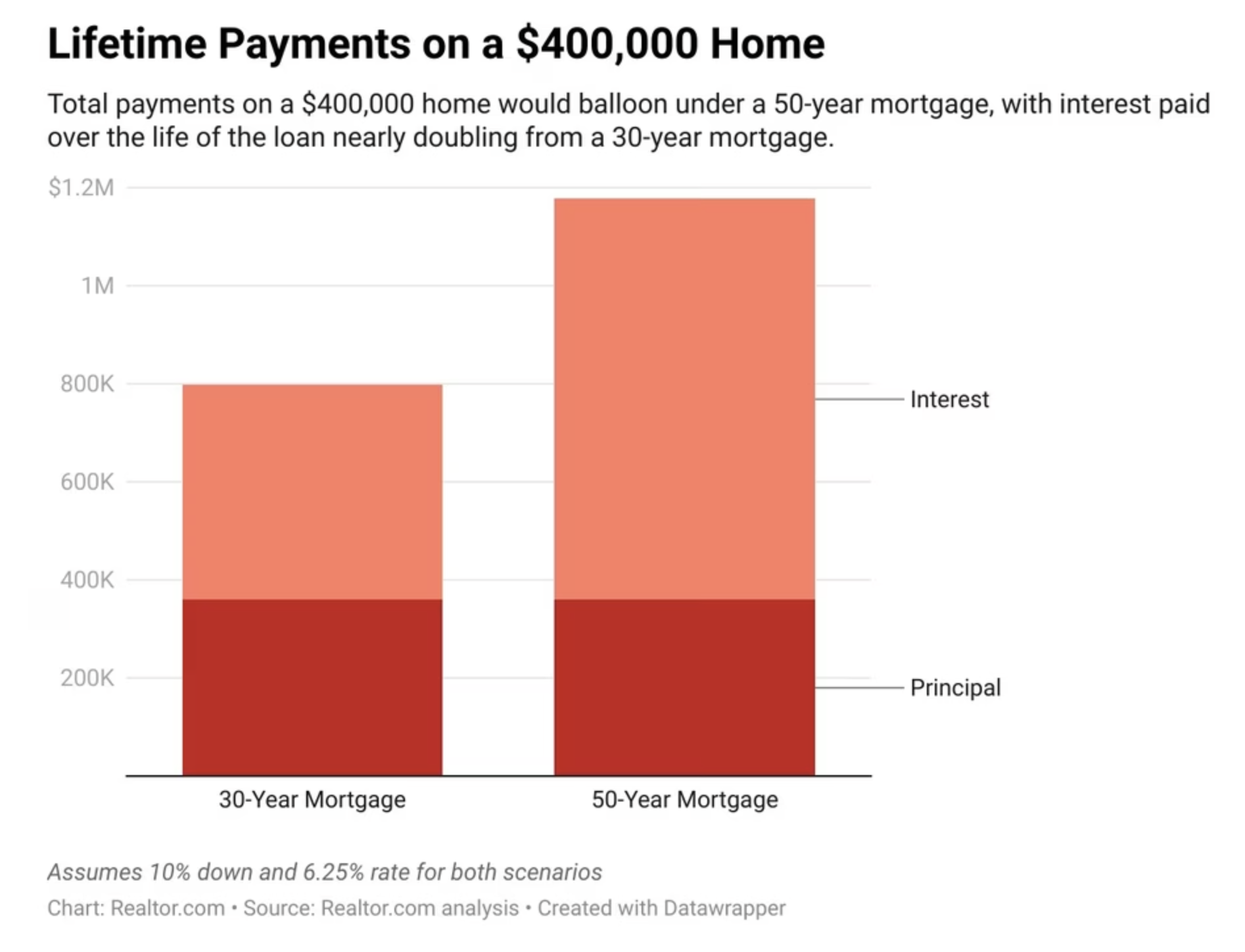

What the Numbers Actually Show

According to Business Insider and AP News, here’s what a typical buyer could expect:

Example 1: $410,000 Home

• 30-year mortgage at 6.5%

– Payment: ~$3,200

– Total interest: ~$470,000

– Total paid: ~$880,000

– Time to reach 20% equity: 95 months

• 50-year mortgage at 7.0%

– Payment: ~$3,088

– Total interest: $1.1 million

– Total paid: Over $1.5 million

📉 Monthly savings: ~$112

📈 Additional interest paid: Nearly $400,000 more

All for just a slightly smaller payment.

Example 2: $348,000 Home

• 30-year at 6% → ~$2,066/mo

• 50-year at 6% → ~$1,832/mo

But total interest jumps from about $403k to $751k — almost doubling.

Pros: Why Some Buyers May Love It

✔ Lower monthly payment

This could finally put homeownership within reach for young buyers priced out of the market.

✔ More demand + stronger buyer pool

If more people qualify, home sales could increase quickly.

✔ Short-term financial breathing room

Families dealing with inflation and higher interest rates might welcome the relief.

Cons: The Costs Are Much Bigger Than They Seem

❌ Equity grows painfully slow

AP reports it could take 30 years just to reach meaningful equity.

❌ You pay hundreds of thousands more in interest

A cheaper monthly payment now = a far more expensive home overall.

❌ Debt into retirement

With the average first-time buyer age at 36, a 50-year loan wouldn’t be paid off until age 86.

❌ Doesn’t fix the real housing problem: SUPPLY

We don’t have enough homes.

More buyers + the same number of homes = higher prices, not lower.

How This Could Change the Market (If Adopted)

1. Short-Term Boost in Buyers

More people qualify → bidding wars intensify → prices rise.

2. Slow Equity Growth

Future refinances, move-ups, and HELOCs would be limited.

3. Investor Strategy Shifts

Some renters become buyers, while others get priced out if demand spikes.

4. More Risk for Lenders

Longer loans = higher chance of default → tighter lending guidelines or higher rates.

5. Regional Differences

In expensive markets like CA or NY, the lower payment may seem attractive.

But in affordable regions, the benefit may not outweigh the long-term cost.

What Buyers Should Consider

✔ How long do you plan to stay?

If you plan to move or refi within 15 years, a 50-year mortgage may cost far more than it saves.

✔ Compare total cost, not just the monthly payment.

The monthly savings are tiny — the long-term cost is massive.

✔ Know that lenders may charge even higher rates to offset risk.

✔ As a Ramsey Trusted Partner — we would never recommend a 50-year mortgage. The long-term financial burden is simply too heavy.

Final Thoughts

A 50-year mortgage sounds like an easy fix, but the trade-off is huge.

It may help some families access homeownership — but it also slows equity growth, balloons interest costs, and potentially pushes debt into retirement.

Run the numbers. Talk to a trusted lender. And don’t chase a lower payment without considering your long-term goals.

If this becomes the next big mortgage trend, buyers need to be informed — and fully aware of the true cost.

listen to the full episode

on your favorite podcast streamer below.

-> Apple

-> Spotify

______________________________________________________________________

Extra Real Estate with Soul Links you can’t miss!

Are you SUBSCRIBED to our YouTube Channel?

Subscribe at https://www.youtube.com/c/LoriAlvarez and tell us you did by messaging us on our

Felt inspired by this episode? Let us know! We'd love to hear from you by leaving our Podcast a review. And you just might get a special shout-out on the podcast! Thanks for choosing to spend your time with us!

Want more behind the scenes?

Like our Real Estate With Soul, The Podcast Page on Facebook

- Agent 4

- Airbnb 1

- Buy and Sell Real Estate 41

- Buyer 43

- Buyer Agent 1

- Buying 23

- Buying young 2

- COVID 1

- California real estate 46

- California real estate market 28

- Career 9

- Community 11

- Dave Ramsey 3

- Eco-friendly 1

- FSBO 1

- Family 6

- Financial Planning 7

- Goal Setting 15

- Guest 23

- Holidays 4

- Homeowner 22

- Homeshowings 1

- Inspections 2

- Insurance 2

- Investing 13

- Legal 1

- Lender 5

- Market 11

- Market Trends 1

- Market Update 10

- Mindset 28

- Mortgage 6

- Moving to California 6

- Owning Property 1

- Photos 1

- Pools 1

- Real Estate 2023 23

- Real Estate 2025 30

- Real Estate Agent 86

- Real Estate Fraud 1

- Real Estate Questions 1

- Real estate 2023 23

- Realtor 8

- Renting 2

- Safety 4

- School 4

- Seller 40

- Selling 23

- Testimonial 1

- The Real Value of a REALTOR 2

Disclaimer: Please verify all information with the licensed professional of your choice.