211: Busting the Biggest Homebuying Myth: Do You Really Need 20%

For decades, the golden number in real estate has been 20% down. It was seen as the responsible, “rule of thumb” amount you needed to buy a home. But here’s the truth: while 20% comes with benefits, it’s not required — and believing this myth may actually be holding millions of buyers back from homeownership.

2

Why 20% Became the Standard

Historically, lenders favored 20% down because it reduced their risk. Buyers had more “skin in the game,” meaning they were less likely to default, and banks were protected in case they did. Plus, putting 20% down allowed borrowers to skip PMI (Private Mortgage Insurance), an extra monthly cost that protects lenders if the borrower defaults.

Over time, though, this preference became a myth — almost like an unspoken rule. And even though the mortgage market has evolved, many people still think they must hit that number before buying.

What Buyers Are Really Putting Down

The reality is, most buyers today aren’t anywhere near 20%. According to the National Association of Realtors (2022 data):

The median down payment across all buyers was 13%.

First-time buyers put down closer to 6–7%.

Repeat buyers averaged 17%, often using equity from a previous home.

On top of that, several loan programs make homeownership possible with even less:

FHA Loans: as little as 3.5% down.

VA Loans: 0% down for veterans.

USDA Loans: 0% down for qualifying rural areas.

Some Conventional Loans: starting at just 3% down.

Still think you need 20%? Think again.

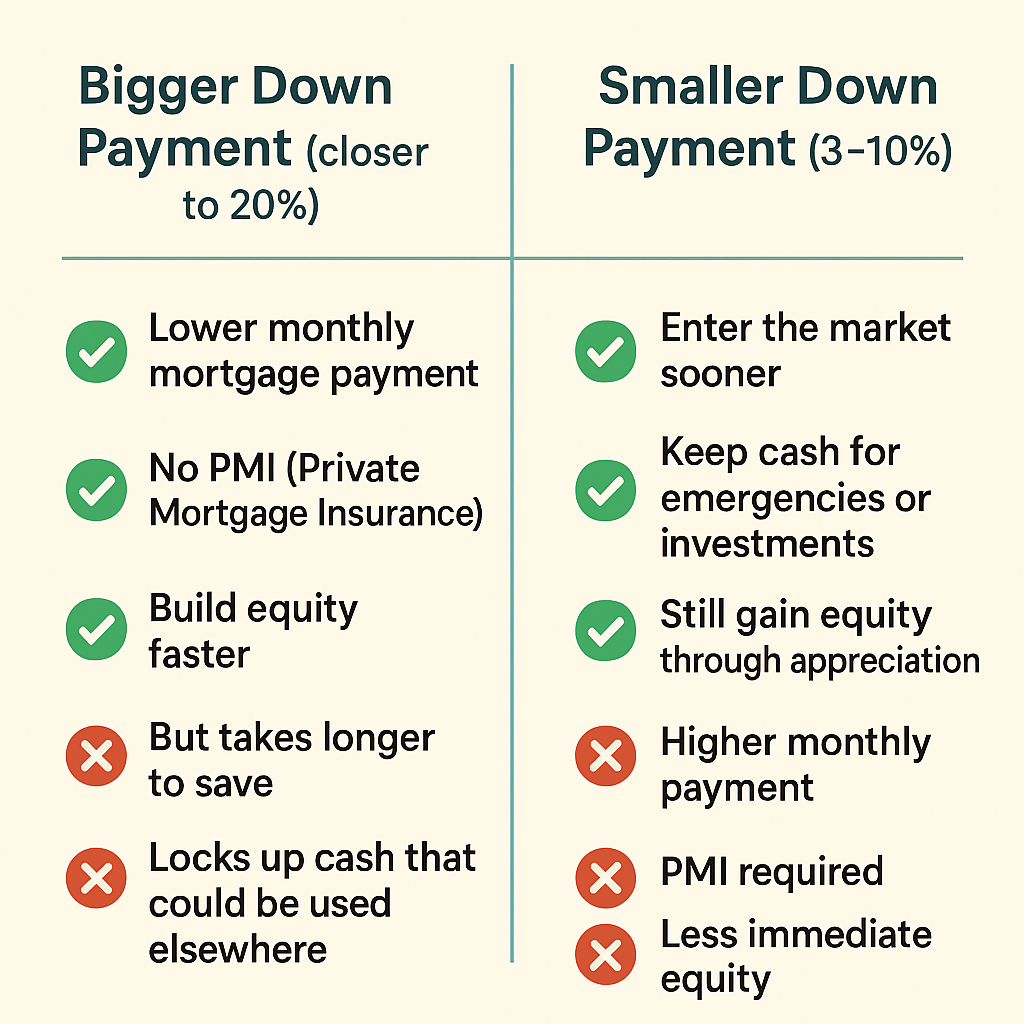

Bigger vs. Smaller Down Payments: Pros and Cons

Closer to 20%:

✅ Lower monthly mortgage payments

✅ No PMI

✅ Build equity faster

❌ Takes longer to save

❌ Locks up cash you might need elsewhere

Closer to 3–10%:

✅ Buy sooner and start building wealth earlier

✅ Keep cash available for emergencies or investments

✅ Still gain equity as your home appreciates

❌ Higher monthly payments

❌ PMI required

❌ Less initial equity

The best choice isn’t about hitting a number — it’s about balancing your financial safety and your goals.

How to Decide What’s Right for You

Check your loan options — FHA, VA, USDA, and conventional loans all have different requirements.

Run the numbers — include PMI, taxes, and insurance in your budget.

Think about your timeline — waiting years to save 20% may cost you more if home prices keep rising.

Keep an emergency fund — don’t drain your savings just to hit a down payment goal.

The Big Takeaway

The 20% rule is one of the biggest myths in real estate, but the truth is clear:

The average first-time buyer puts down around 6–7%.

There are programs with as little as 0–3% down.

While 20% can save you money in the long run, it’s not a barrier to entry.

Homeownership is about balance — finding the sweet spot between opportunity and stability. Don’t let outdated myths stop you from exploring your options. Whether you’re saving, house hunting, or just daydreaming, know this: you have more choices than you think.

listen to the full episode

on your favorite podcast streamer below.

-> Apple

-> Spotify

______________________________________________________________________

Extra Real Estate with Soul Links you can’t miss!

Are you SUBSCRIBED to our YouTube Channel?

Subscribe at https://www.youtube.com/c/LoriAlvarez and tell us you did by messaging us on our

Felt inspired by this episode? Let us know! We'd love to hear from you by leaving our Podcast a review. And you just might get a special shout-out on the podcast! Thanks for choosing to spend your time with us!

Want more behind the scenes?

Like our Real Estate With Soul, The Podcast Page on Facebook

- Agent 4

- Airbnb 1

- Buy and Sell Real Estate 44

- Buyer 43

- Buyer Agent 1

- Buying 23

- Buying young 2

- COVID 1

- California real estate 49

- California real estate market 31

- Career 9

- Community 11

- Dave Ramsey 3

- Eco-friendly 1

- FSBO 1

- Family 6

- Financial Planning 7

- Goal Setting 15

- Guest 23

- Holidays 4

- Homeowner 22

- Homeshowings 1

- Inspections 2

- Insurance 2

- Investing 13

- Legal 1

- Lender 5

- Market 11

- Market Trends 1

- Market Update 10

- Mindset 28

- Mortgage 6

- Moving to California 6

- Owning Property 1

- Photos 1

- Pools 1

- Real Estate 2023 23

- Real Estate 2025 33

- Real Estate Agent 89

- Real Estate Fraud 1

- Real Estate Questions 1

- Real estate 2023 23

- Realtor 8

- Renting 2

- Safety 4

- School 4

- Seller 40

- Selling 23

- Testimonial 1

- The Real Value of a REALTOR 2

Disclaimer: Please verify all information with the licensed professional of your choice.